The Property Tax Paradox: Why Your House Gained Value While You Slept

Your property taxes went up—but your house didn’t change. Discover the absurd truth behind “comparables” and the simple fix that could freeze the madness.

Image created with generative Ai.

Let us begin with an observation so obvious it becomes invisible: nothing about your house has changed—and yet it is somehow worth $100,000 more than last year.

The roof still leaks when it rains sideways. The fence still leans like a drunk uncle at a barbecue. And your neighbor still insists on parking his boat (on land!) directly across from your living room window. And yet, according to your friendly neighborhood tax assessor, you now live in Versailles.

This, dear reader, is the curious voodoo of comparables—a system where your tax bill is based not on your home, but on other people’s. Imagine if you were billed for dinner based on what the table next to you ordered. “Sorry sir, I see you had the soup and breadsticks, but someone nearby ordered the lobster tower and a bottle of 2005 Châteauneuf-du-Pape, so that’ll be $300.”

Welcome to the logic of property tax valuation in Texas.

Comparables: The Original Social Media Curse

The idea of using “comps” is one that appeals only to people who do not actually live in homes. It’s the same logic as Zillow, only weaponized by the state. You didn’t upgrade your kitchen? Doesn’t matter. Someone three blocks away did, and now you get to pay for it too. The system mistakes market heat for personal wealth, as though the rising tide that floats all boats also pays your mooring fees.

It’s behavioral madness: taxing people not on what they’ve done, but on what others have done around them. It's taxation by proximity.

The Lock-In Solution: Freezing the Madness

What if we took a cue from behavioral economics—and from, dare I say, common sense—and simply locked in your property tax value the day you buy the home?

This is not revolutionary. It is evolutionary. Your home’s tax valuation is set when you acquire it. It doesn’t budge—doesn’t twitch, flinch, or drift—until you sell it. At which point, a new owner takes on a new valuation, and the cycle continues. Value still rises, yes, but in digestible, psychologically sane chunks. Like stair-steps, not geysers.

This gives the homeowner certainty. Stability. And, crucially, decouples the value of your home from the frantic, casino-like froth of the local housing market.

Governments might grumble at first—fewer windfall gains for municipal coffers—but let’s be honest: the government's job isn’t to speculate on housing like a day trader. It’s to provide roads, schools, and stop signs that don’t spin in the wind.

But What About Equity? Efficiency? Modernity?

Ah yes, the dreaded technocrat's rebuttal. “But this system isn’t efficient!” they say.

To which I say: neither is childhood, marriage, or democracy—and yet we keep them around, because they serve a deeper human function. They recognize that people are not spreadsheets. That predictability beats theoretical fairness. That no one likes being punished for doing absolutely nothing.

Tax systems, like trousers, work better when they don’t ride up.

A Modest Proposal (Without the Cannibalism)

So here it is: freeze the tax valuation at point of sale. Let people budget. Let neighborhoods stabilize. Let the assessors assess new construction, not your 1970s ranch with the asbestos ceiling and commemorative popcorn ceiling texture.

Because the only thing worse than rising taxes is not knowing why they’re rising. And nothing, I mean nothing, undermines faith in public institutions faster than the creeping suspicion that you're being charged for your neighbor’s marble countertops.

The Nostalgia Index™: Why Most Rebrands Fail Before They Start

Why do so many rebrands crash and burn? Because companies forget the one thing you can’t buy: nostalgia. The Nostalgia Index™ is a simple way to measure it before you accidentally piss off your audience.

Image created with generative Ai.

You’ve seen it before: a big, shiny rebrand drops, the internet explodes in mockery, and within weeks the company quietly scurries back to its old look. Gap’s infamous 2010 logo fiasco. Tropicana’s carton redesign that lasted all of two months. Mostly recently, Crack Barrel’s failed attempt to remove their ‘old timer.’

These aren’t failures of design talent. They’re failures of memory. Companies forget that their brand isn’t just artwork — it’s a collection of emotional anchors buried in their audience’s brains. Mess with those anchors, and you’re not just “modernizing.” You’re cutting the cord on decades of trust and familiarity.

So here’s a radical thought: if we can measure user sentiment in UX, why can’t we measure audience nostalgia in branding?

Enter: The Nostalgia Index™.

The Real Problem With Rebrands

Executives usually frame rebrands as progress:

We’ve outgrown the old look.

We need to appear more modern.

This signals a new era for the company.

All fine reasons. But they forget that customers aren’t living in the boardroom. Customers are living in their kitchens, their cars, their childhood bedrooms — where the old logo is tied to real life memories. That logo might be on the cereal they ate before school. That tagline might remind them of Saturday morning cartoons.

Nostalgia is cheap trust. You can’t buy it. You can only earn it over time. And if you throw it out in one swoop, you’re gambling with goodwill you may never get back.

Introducing The Nostalgia Index™

Here’s the pitch: instead of treating nostalgia as a fuzzy “vibe,” let’s treat it like a metric. A simple, structured way to understand how much emotional weight your old brand carries.

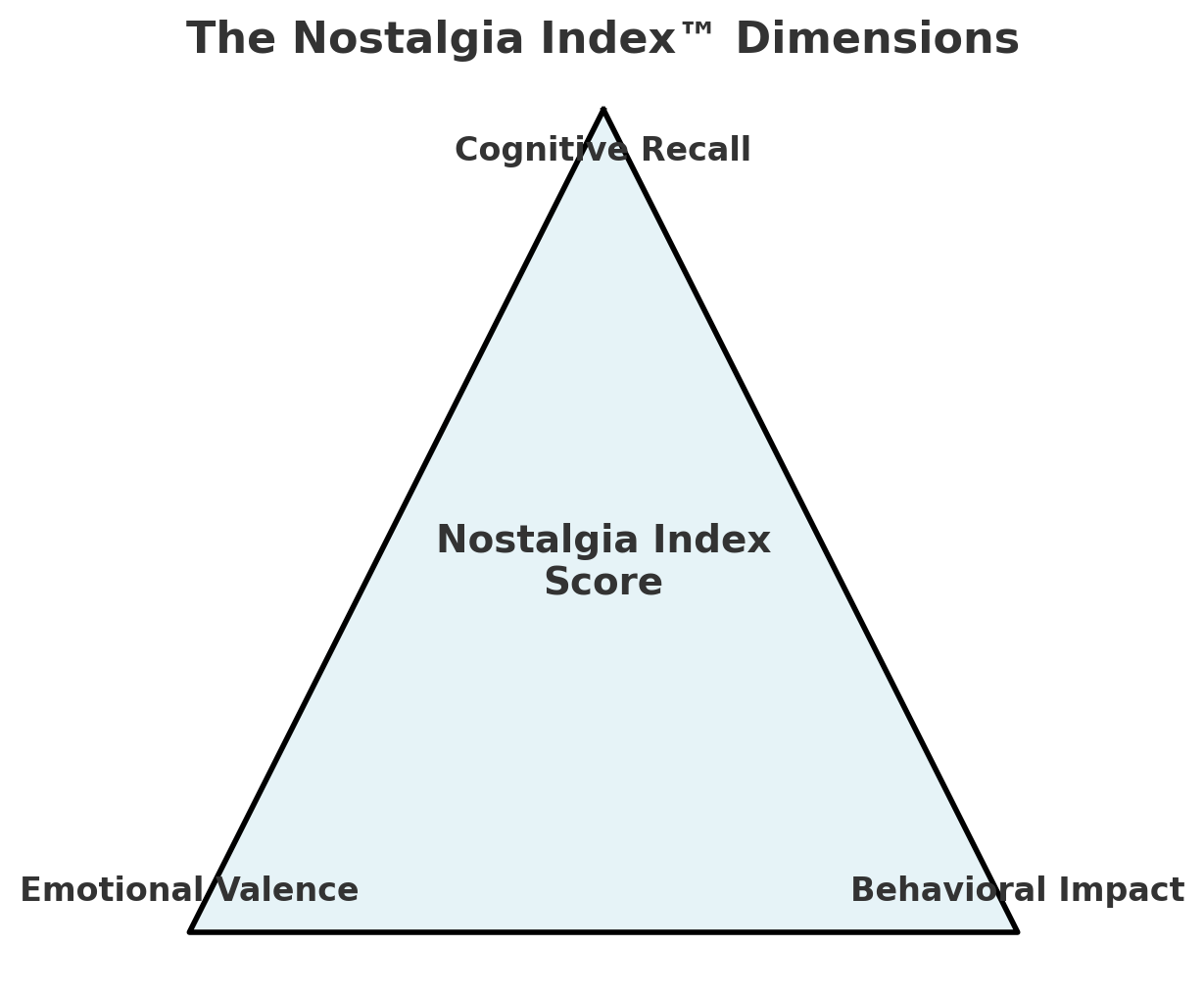

The Nostalgia Index™ has three dimensions:

1. Cognitive Recall

Do people remember the old stuff?

Test recall of logos, slogans, jingles.

Example metric: % of people who can identify or describe your legacy brand elements.

2. Emotional Valence

How do they feel when reminded?

Use Likert scales or word associations: “This old logo makes me feel… warm / proud / embarrassed / indifferent.”

Example metric: average emotional affinity score.

3. Behavioral Impact

Does nostalgia change choices?

A/B test new vs. retro packaging.

Track social spikes when you lean into heritage in campaigns.

Example metric: relative lift in engagement or purchase.

Combine them into a weighted score — voilà, your Nostalgia Index.

Triangle diagram showing the three dimensions of The Nostalgia Index™ (Cognitive Recall, Emotional Valence, Behavioral Impact).

How to Use the Index

Before a Rebrand

Run a quick nostalgia test. If your audience scores high, tread carefully. Maybe don’t toss everything. Maybe keep the mascot. Or at least explain why you’re making changes.

During a Rebrand

Phase it in. Slow burns work better than sudden amputations. Google, for example, evolved its logo dozens of times without ever shocking the system.

After a Rebrand

Keep measuring. Did the nostalgia score drop like a rock? That’s your early warning signal. Did it stabilize or even rebound as people embraced the new look? Great, you threaded the needle.

Sample timeline chart showing how nostalgia scores can shift before, during, and after a rebrand.

What Happens If You Ignore It

Ask Tropicana. They lost $30 million in sales in less than two months after their redesign. Why? Customers couldn’t find “their” juice anymore. It wasn’t just a packaging change; it was a memory wipe.

Ask Gap. Their shiny new logo survived all of six days. Nostalgia backlash was so fierce they ditched it almost immediately.

And more recently, ask Cracker Barrel. Their attempt to modernize their image by downplaying the very “country charm” that made them iconic sparked outrage among their loyal base. For decades, the brand signaled comfort food and nostalgia for road trips — until they started sanding off the rustic edges. Customers didn’t see it as progress; they saw it as betrayal.

These weren’t just bad designs — they were nostalgia blindspots.

Beyond Branding

While The Nostalgia Index is aimed at branding and rebrands, you’ll see echoes everywhere:

UX/Product Design: That classic “File > Edit > View” menu at the top of apps? Remove it, and watch chaos ensue.

Entertainment: Hollywood reboots bank entirely on nostalgia. Some soar (Cobra Kai), others flop (every bad remake you’ve forgotten).

Politics: Campaign slogans recycled for emotional resonance. (“Make America Great Again” wasn’t new — it was Reagan’s in the 1980s.)

The lesson: nostalgia isn’t just a soft feeling. It’s a design constraint you ignore at your peril.

Try It Yourself: A Mini Nostalgia Index

Here are three quick questions you can ask your audience tomorrow:

Do you remember the old [logo/tagline/jingle]? (Yes/No)

How do you feel about it? (Positive/Neutral/Negative)

Would you choose a product with the old branding over the new? (Yes/No/Maybe)

Congratulations, you’ve just run your first Nostalgia Index test.

The Takeaway

Rebrands don’t fail because they’re ugly. They fail because they erase memory.

The Nostalgia Index gives you a way to measure that memory before you kill it. It won’t guarantee success, but it will keep you from being the next Gap headline.

Or put another way: don’t piss off your audience. Respect their memories, and they’ll forgive you for changing. Ignore nostalgia, and they’ll never forgive you for forgetting them.

Turning Payroll Into a Tax Strategy

What if the tax code rewarded companies for paying people well? This post explores a simple idea: lower corporate taxes for firms that shrink the CEO-to-worker pay gap and grow full-time jobs. More people, better pay, fewer taxes—it’s a win for workers and the economy.”

Image created with generative Ai.

America’s tax code rewards all kinds of things: owning property, making investments, even parking your money offshore. But what if it rewarded something more fundamental—something that could reshape work and wages for millions of people?

Imagine this: the more people a company employs, and the better those employees are paid, the less that company pays in corporate taxes.

That’s it. Simple, direct, and fair.

The Core Idea

Pay Equity: Companies that narrow the gap between average worker pay and CEO pay earn lower tax rates. (For context: CEOs at S&P 500 firms make over 270 times what their average employee earns. In 1980, that ratio was about 30 to 1.)

Employment Growth: Companies that hire more full-time American workers (with benefits) also earn lower tax rates.

Annual Average Counts: Employee numbers are calculated on an annual average, so no company can game the system by hiring a bunch of workers on December 31.

No Loopholes: Contractors don’t count. Only full-time Americans, benefit-receiving employees are eligible.

This flips the incentive structure. Instead of rewarding stock buybacks, executive bonuses, or short-term profit grabs, companies now see tax relief when they strengthen their payrolls—the backbone of any healthy economy.

Why It Works

Paychecks Drive Growth: Wages aren’t just a line item—they’re fuel. Every extra $1 in wages for a low- or middle-income worker adds about $1.50 to $2.00 in economic activity because that money gets spent in the real economy.

CEO Pay vs. Worker Pay: At companies where executives make over 300x more than their workers, morale and retention plummet. A narrower gap keeps both people and profits healthier.

Encourages Hiring at Home: Imagine a system where a company adding 1,000 middle-class jobs could lower its tax rate by several percentage points. Suddenly, investing in people is as attractive as investing in machinery.

Possible Add-Ons

Employee Health Modifier: Healthier employees lower insurance costs for everyone. U.S. companies lose about $225 billion per year in productivity from illness-related absenteeism. Cutting that bill is a win-win.

Debt Reduction Modifier: U.S. workers hold about $1.7 trillion in student loan debt. Companies that help reduce it could unlock even more spending power.

Tariff Relief: For companies hitting equity and employment targets, tariffs on imported supplies could be lowered or removed—further reducing costs and boosting competitiveness.

These modifiers make the system holistic. It’s not just about more jobs—it’s about better jobs.

The Genius of It

This isn’t about punishing success; it’s about rewarding responsibility. Companies that truly share prosperity with their people get to keep more of their own profits. It reframes corporate taxes from a penalty for making money to a discount for making money the right way.

Instead of debates over minimum wage hikes, we could let the market respond to a smarter tax code. Want to pay your CEO 600x more than your average worker? Fine, but it’ll cost you. Want to expand your payroll and pay people fairly? You’ll see your tax bill shrink.

Closing Thought

For too long, we’ve designed our system around the myth that shareholder value is the only value. A payroll-based tax code says otherwise. It says: if you build a company that pays well, hires broadly, and treats people like assets instead of costs—you deserve a break.

It’s a win for workers, a win for responsible companies, and a win for the economy.